Review each section of the digital strategy. Click any card to dive deeper. Questions requiring your input are marked with a count.

Digital Marketing Strategy Research

Three-site brand strategy with verified market data across Las Vegas, San Diego, and Los Angeles.

Strategy Overview

Competitive Landscape Data

Analysis of 14 Las Vegas CRE competitors reveals significant gaps in digital presence. Most brokers have basic websites but lack lead capture, content strategy, and market positioning.

Industry Benchmark Data 5 key metrics

CRE prospects searching online

Data suggests digital presence is increasingly expected

Placester 2026LinkedIn vs FB/Twitter leads (B2B)

Data suggests LinkedIn may offer stronger B2B lead potential

HubSpotEmail vs social conversion

Higher conversion suggests email lists can be effective

Promodo 2026Touchpoints before conversion

15 digital + 12 human interactions

ForresterBrokerages using AI

High adoption indicates AI content assistance is widespread

Delta Media 2026Market Context (3 Markets) Las Vegas · San Diego · Los Angeles

Licensed in all three markets with distinct opportunities in each:

Low (<10%) Medium (10-15%) High (>15%)

-

Q1: What percentage of your current deals come from each market?Example: "70% Vegas, 20% San Diego, 10% LA" — This determines content weighting and ad spend allocation.

-

Q2: Which property types do you prefer working with in each market?Industrial is tight in LA (4.6%) but looser in Vegas (12.8%). Office is distressed in LA (24%) — opportunity or avoid? Retail is tight everywhere.

-

Q3: Are there specific submarkets within LA or SD you focus on?LA is huge — Inland Empire industrial? Downtown office? Orange County retail? San Diego life sciences corridor?

Brand & Site Strategy

Three-site "MyCommercial" brand family approach. Each site serves a distinct purpose with consistent color palette but different personalities.

Three-Site Brand Family

-

Q4: Which domain name resonates most for the content/intel site?Options: mycommercial______.com, mycommercialinsider.com, mycommercialintel.com, mycommercialguide.com, mycommercialedge.com — Check availability and preference.

Three-Site Architecture

Different People Want Different Things

Multi-Site Architecture: Potential Benefits

Each Site Captures Different Searches

Honest Assessment

- 3x SEO surface area

- Better conversion per site

- Right tone for each audience

- Clear lead attribution

- Test without risk to main brand

- Scalable content engine

- More sites to maintain

- Need consistent branding

- More complex analytics setup

- Content spread across domains

- Higher initial setup effort

- Requires clear internal linking

Customer Journey Through the Ecosystem

Audience Segments by Site

-

Q5: Rank these audiences by revenue potential for YOUR business (1-5):Property Sellers, Balloon Payment Owners, Investors, Buyers (Owner-Occupants), Tenants, Market Watchers — This determines which lead forms and content we prioritize.

-

Q6: Would you rather launch two sites strong or three sites lean?Option A: kwcommercial.properties + mycommercialvalue.com first, third site later. Option B: All three simultaneously with lighter content.

-

Q7: What's your average deal size by audience type?Example: "Seller rep = $500K avg commission, Tenant rep = $50K avg, Investor = $200K avg" — Helps prioritize high-value segments.

Velocity Levers

Current resources and how each lever can be accelerated. Color-coded by who handles what.

Current Team Capacity 4 resources

| Resource | Availability | Handles |

|---|---|---|

| You | Limited (running business) | CRE expertise, approvals, client relationships, RealNex |

| VA | Available | Template tasks, scheduling, data entry, formatting |

| Bryan | Development + Strategy | Website, SEO engine, content direction, AI integration |

| AI Tools | On-demand | Content drafts, graphics, email sequences, analysis |

Foundation Levers (One-Time Setup) 7 setup tasks

| Lever | Owner | AI Assist | External? | Impact |

|---|---|---|---|---|

| Website build | Bryan | Code assist | — |

|

| SEO content engine | Bryan | Content generation | — |

|

| RealNex MP Premier | You | — | — |

|

| Lead forms (5 audiences) | Bryan | — | — |

|

| Google Business (3 cities) | VA | — | — |

|

| LinkedIn optimization | You + Bryan | Profile copy | — |

|

| Professional photography | — | — | Photographer |

|

Content Engine Levers (Ongoing) 6 recurring activities

| Lever | Owner | AI Assist | External? | Frequency |

|---|---|---|---|---|

| Blog articles | Bryan direction | AI first drafts | — | Weekly |

| Market reports | You data | AI format | — | Quarterly |

| LinkedIn posts | Bryan direction | AI drafts | — | 3x/week |

| Social graphics | VA executes | AI generate | — | 3-5x/week |

| Email newsletter | Bryan direction | AI drafts | — | Bi-weekly |

| Case studies | You input | AI narrative | — | As deals close |

-

Q8: How many hours per week can you dedicate to content review/approval?Be realistic: 1-2 hours? 3-5 hours? This determines whether we need pre-approved templates or case-by-case review.

-

Q9: Which content types MUST have your direct approval before publishing?Options: All content, only case studies/deal announcements, only client-facing emails, only blog posts with your name. Some can run with lighter oversight.

-

Q10: What's your preferred communication channel for approvals?Email, Slack, text, shared doc comments? We'll design the workflow around your preference.

Scaling Approach

We start with current team resources and scale up as needed. This progression depends on your available resources, scope, and pace preferences.

- You (strategy, relationships, approvals)

- VA (data entry, scheduling, admin tasks)

- Bryan (technical build, integrations)

Foundation phase - establish workflows and prove concept before adding resources.

- AI drafts content (you review/approve)

- AI generates graphics and market visuals

- Parallel workflows - multiple tracks at once

Productivity multiplier - same team, 50-60% faster output with AI tools.

- Dedicated visual design resources

- Custom identity per site

- Maximum parallelization of all tracks

Premium acceleration - consider if timeline is critical or for future site launches.

-

Q11: Who else in your network could contribute to this project?Other agents in your office, referral partners, KW Commercial corporate resources, existing vendors?

-

Q12: What's your comfort level with AI-assisted content creation?AI drafts that you review vs. fully manual. Most brokers find AI saves 50%+ time on market reports, listing descriptions, social posts.

-

Q13: Is there a launch date or event driving the timeline?This helps us determine whether to start lean or accelerate with additional resources from the beginning.

Phased Timeline

Proposed phases assuming AI-assisted scenario. Adjust based on speed decision above.

- Website structure & core pages

- RealNex MP Premier configuration

- Lead capture forms (priority audiences)

- LinkedIn profile optimization

- Professional photography session

- SEO content automation live

- Weekly blog publishing begins

- Email nurture sequences active

- Social media cadence established

- First market report published

- RealCampaigns drip sequences

- Balloon payment outreach begins

- Partner cultivation active

- Google Business profiles optimized

- First case studies / deal tombstones created

- Double down on what's working

- Cut underperforming channels

- Scale successful content types

- Expand into adjacent niches

- Continuous improvement cycle

-

Q14: What does "success" look like at 90 days?Options: X leads per month, Y consultation calls, Z deals in pipeline, specific revenue target, LinkedIn follower count, newsletter subscribers. Pick 2-3 primary metrics.

-

Q15: What's your current monthly lead volume (baseline)?Understanding current baseline helps measure improvement. Example: "5 inbound leads/month" → target "15 leads/month" = 3x improvement.

-

Q16: How do you currently track leads and deals?RealNex CRM only? Spreadsheet? Nothing formal? We'll integrate digital leads into whatever system you use.

-

Q17: What would make you STOP or PIVOT the strategy?Define failure criteria: "If we don't see X by week 8, we should reconsider Y." Prevents sunk cost fallacy.

Audience Funnels & List Building

Each audience enters through different content, joins a relevant list, and converts when ready. Tenant representation provides faster cycles while we build the full engine.

The Funnel Strategy

- LinkedIn posts

- Instagram content

- SEO / Google

- Referral partners

- Market reports

- Property valuations

- Tenant search form

- Newsletter signup

- Email sequences

- Property alerts

- Market updates

- RealCampaigns

- Consultation request

- Valuation inquiry

- Space requirements

- Direct reply

- Site tour / meeting

- BOV presentation

- Listing agreement

- Deal negotiation

Audience-Specific Lists 5 audience types mapped

| Audience | Entry Content | List/Capture | Lead Trigger |

|---|---|---|---|

| Tenants | "Space available" posts, tenant guides, lease tips | Tenant search list | Submits space requirements |

| Sellers | Valuation content, market reports, balloon payment info | Property alerts list | Requests valuation or listing |

| Buyers (Owner-Occupants) | "Own vs. lease" content, property availability, market reports | Buyer search list | Submits buyer consultation form |

| Investors | Deal analysis, cap rate trends, market intel | Investment insights list | Submits investment criteria |

| Market Watchers | Blog posts, market commentary, data reports | Newsletter subscribers | Engages with higher-intent content |

Content → List → Lead Flow 3 funnel workflows

Tenant Funnel (Short-Term Priority)

-

Attract:"Looking for space?" LinkedIn posts, lease expiry content

-

Capture:Space requirements form, tenant guide download

-

Convert:Site tour scheduling, lease negotiation

Seller/Investor Funnel (Long-Term Build)

-

Attract:Market reports, valuation content, balloon payment alerts

-

Capture:Property valuation form, investment criteria form

-

Convert:Listing agreement, investment representation

Buyer Funnel (Owner-Occupants)

-

Attract:Property alerts, "own vs. lease" content, market availability

-

Capture:Buyer consultation form, property search criteria

-

Convert:Buyer representation, property tours, acquisition

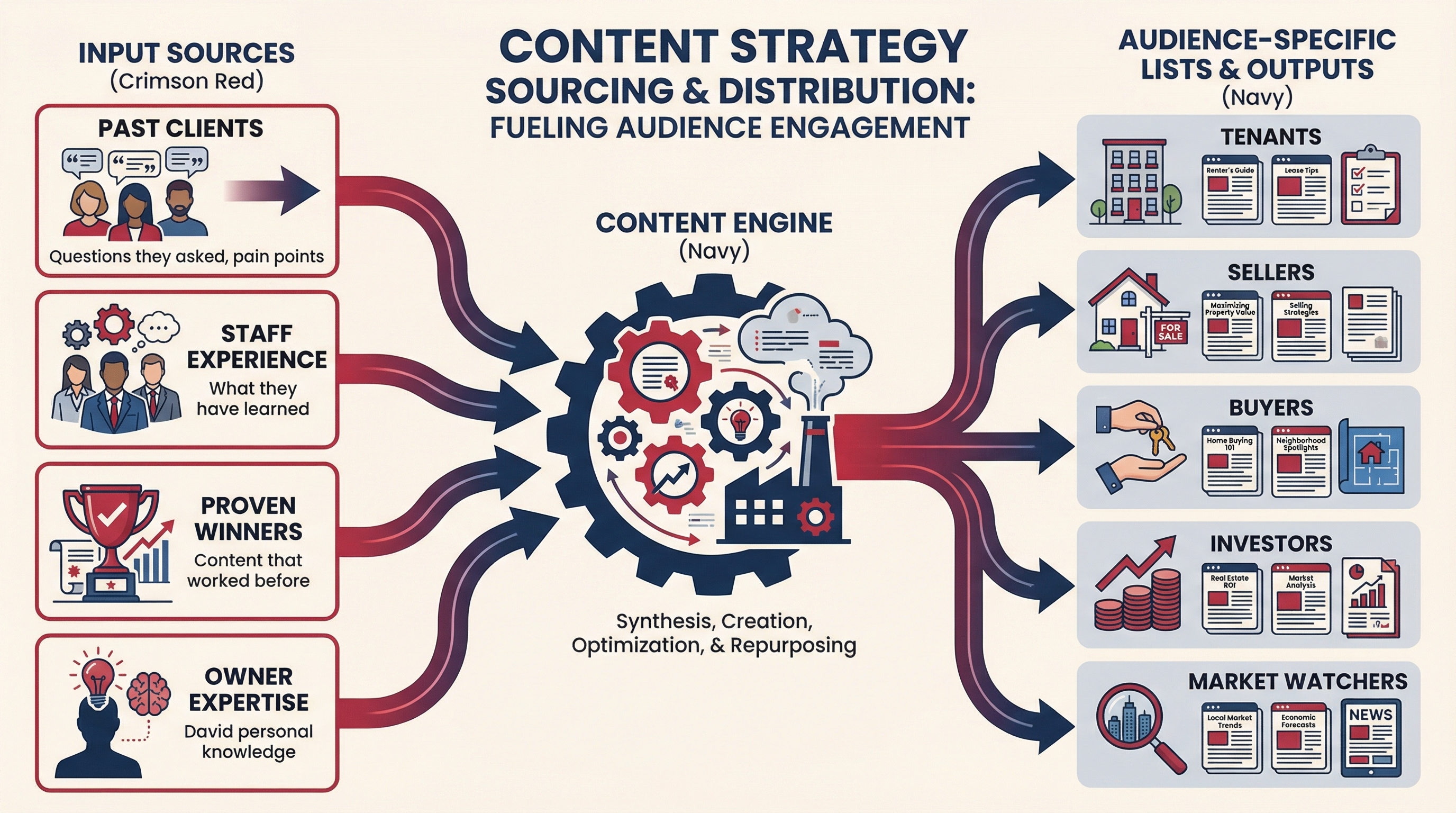

Content Strategy: Sources to Audience Lists

-

Q18: Which audience do you have the most existing relationships with?Tenants, investors, property owners, other brokers? Consider amplifying where you already have credibility.

-

Q19: What topics do people ALREADY ask you about?Market trends? Valuation methods? Lease negotiation tips? Balloon payment options? These become your first content pillars.

-

Q20: Do you prefer short-term wins (tenant rep) or long-term pipeline (seller/investor)?Tenant deals close faster but smaller. Seller/investor deals are larger but take longer. This affects funnel priority.

-

Q21: What existing content or materials do you have?Past presentations, market reports, email templates, case study notes? We can repurpose existing assets rather than starting from scratch.

RealNex Competitive Edge

RealNex provides capabilities most competitors don't leverage. These are potential differentiators if we build workflows around them.

| Capability | Competitive Edge | Workflow Opportunity |

|---|---|---|

| Loan maturity data | Contact owners BEFORE balloon due | Proactive outreach sequences |

| Predictive analytics | Highest-probability sellers | Prioritized prospecting lists |

| 100K+ prospect database | Scale that smaller brokers lack | Segmented campaigns |

| RealCampaigns automation | Consistent follow-up at scale | Drip sequences for each audience |

Research Status & Open Items

Status of research items and remaining questions that need your input.

Supporting Research Documents

Resolved (Data Now Available)

-

✓ San Diego & Los Angeles market dataVacancy rates, rents, and trends now populated in Section 1. Sources: Cushman & Wakefield, CBRE, JLL.

-

✓ Industry benchmark statistics verifiedAll major stats confirmed with 2026 sources. Added citations throughout document.

Open Items - Need Your Input

-

Q22: Name your top 3 referral partners in each marketLenders, CPAs, attorneys you already work with or want to cultivate. We'll build partnership outreach around these.

Future Considerations (Deferred)

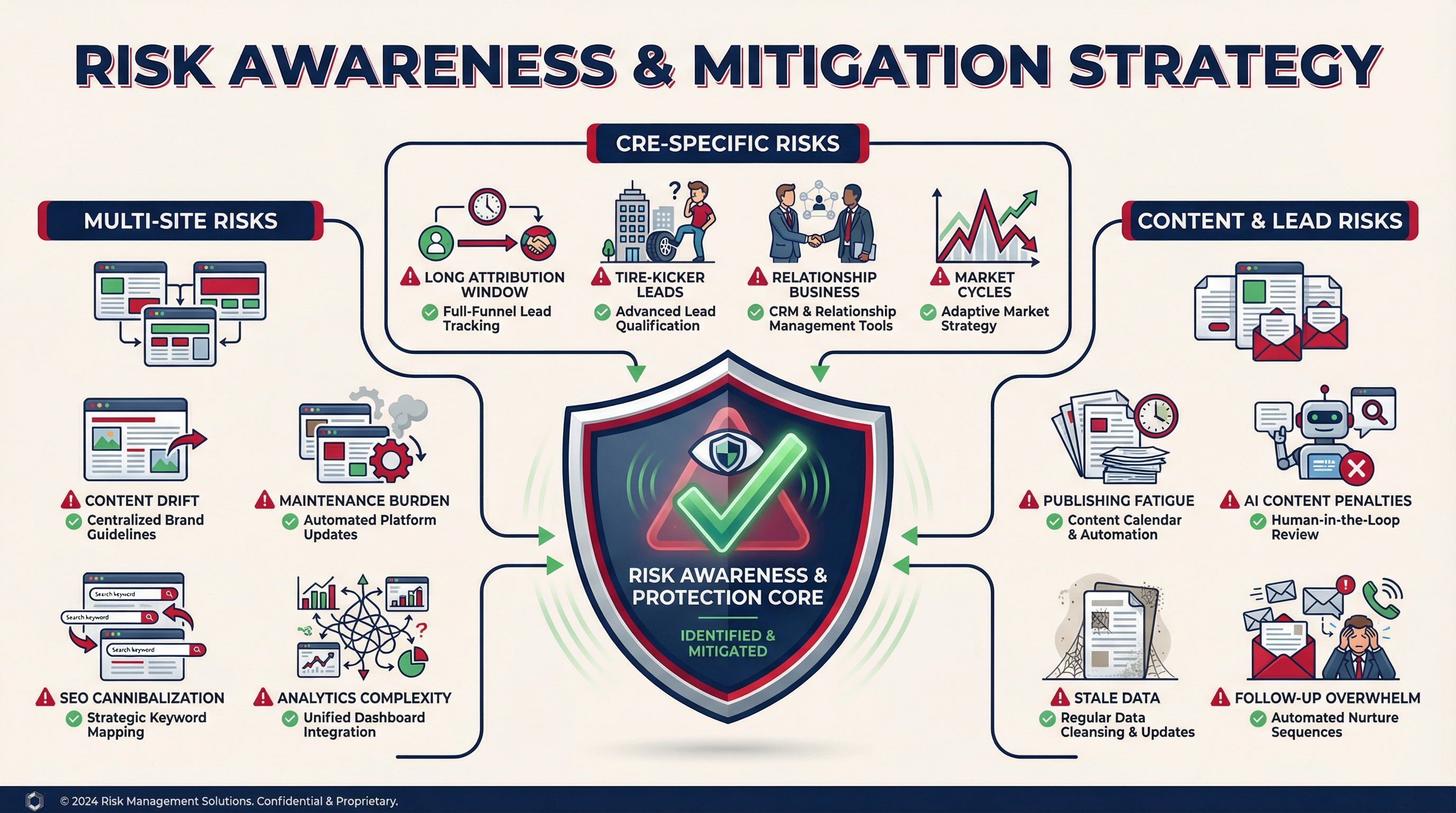

Common Pitfalls & Risk Awareness

Multi-site CRE digital strategies have common failure modes documented in the industry. Understanding these upfront can inform planning decisions.

Multi-Site Management 4 pitfalls

| Pitfall | Risk | Mitigation |

|---|---|---|

| Content drift | Sites become inconsistent in messaging/branding over time | Style guide, templates, regular audits |

| Maintenance burden | 3x updates, security patches, hosting issues | Shared hosting/platform, VA checklist |

| SEO cannibalization | Your own sites compete for same keywords | Distinct keyword focus per site |

| Analytics complexity | Hard to track full journey across sites | Cross-domain tracking, unified dashboard |

CRE-Specific Challenges 4 pitfalls

| Pitfall | Risk | Mitigation |

|---|---|---|

| Long attribution window | Deal closes 12+ months after first touch — hard to prove ROI | Track touchpoints, not just "last click" |

| Tire-kicker leads | "Free valuation" attracts people not ready to sell | Qualify with form questions, phone screen |

| Relationship business | Digital supplements but doesn't replace referrals | Content supports conversations, doesn't replace them |

| Market cycles | Strategy launches during downturn, looks like failure | Set realistic expectations, track leading indicators |

Content & Lead Management 5 pitfalls

| Pitfall | Risk | Mitigation |

|---|---|---|

| Publishing fatigue | Can't maintain 3x/week cadence long-term | Start smaller, build systems first |

| AI content penalties | Google devalues low-quality generated content | AI assists, human reviews and adds expertise |

| Stale market data | Reports with outdated vacancy rates damage credibility | Quarterly refresh schedule, date-stamp everything |

| Follow-up overwhelm | More leads than capacity to handle well | Automated nurture for cold, focus time on hot |

| Response time | CRE leads expect fast response, especially investors | Alerts, templates, VA first-response |

-

Q23: How many inbound leads per week can you realistically follow up on personally?Be honest — 5? 10? 20? This determines whether we optimize for volume or quality, and how much automation we need.

-

Q24: What's your tolerance for "unqualified" leads in exchange for volume?Free valuation forms get more submissions but lower quality. Gated content (requiring more info) gets fewer but more serious inquiries.

-

Q25: How long are you willing to wait before judging the strategy's success?CRE deals take months to close. SEO takes 3-6 months to show results. If we need wins in 30 days, the approach changes significantly.

-

Q26: What percentage of your current business comes from referrals vs. inbound?If it's 90% referrals, digital is additive. If it's 50/50, digital could significantly move the needle. This sets ROI expectations.

-

Q27: Have you tried digital marketing before? What worked or didn't?Past experience (good or bad) helps us avoid repeating mistakes and build on what's worked.

Review Your Answers

Review and complete all questions before submitting. Answered questions are collapsed by default.

Submit Your Responses

Once you've reviewed your answers above, add any additional comments and click submit to send your responses to Bryan.

Your answers are saved locally and will be emailed to Bryan at AliraLink for review.

Sources & Citations

All market data and statistics verified January 2026. Links provided for reference.

Marketing & Lead Generation

- • Placester — Real Estate Marketing Trends 2026 (92% CRE online search)

- • HubSpot — B2B Marketing Insights (LinkedIn 277% more leads)

- • Promodo — Real Estate Marketing Benchmarks 2026 (Email 40% better conversion)

- • Forrester / B2B Marketing Zone — Touchpoints Report (27 touchpoints)

- • Delta Media — AI Survey January 2026 (97% brokerages using AI)

Las Vegas Market Data

- • Cushman & Wakefield — Las Vegas MarketBeats Q4 2025

- • JLL — Las Vegas Industrial Market Dynamics

- • Avison Young — Las Vegas Retail Market Report

San Diego Market Data

- • Cushman & Wakefield — San Diego MarketBeats Q4 2025

- • CBRE — 2025 U.S. Real Estate Market Outlook

- • SCCAI — Southern California Commercial Real Estate Outlook

Los Angeles Market Data

- • Cushman & Wakefield — Greater Los Angeles MarketBeats Q4 2025

- • KEYZ Commercial — Southern California Cap Rates 2025 Outlook

- • CommercialCafe — National Office Market Report

Competitive Analysis

- • Primary Research — 14 CRE competitor websites analyzed